Q. As we continue to watch the ups and downs of the stock market, how could significant losses affect the California State Teachers’ Retirement System’s (CalSTRS) full funding plan and employer contribution rates?

A. First, here is a quick refresher on how the CalSTRS Funding Plan works. Under current law, CalSTRS is to be fully funded by 2046, based on a combination of employee, state, and employer contribution rate increases. The CalSTRS Board has some authority to increase the contribution rates of both employers and the state. This authority has limitations (can only go up a certain percentage each year, and the employer rate caps out at 20.25%) and is to be adjusted based on meeting the goal of exhausting the unfunded liability for the state and employers, respectively, by 2046.

As a reminder, the unfunded liability is not one lump sum: the state is currently responsible for about 80% of CalSTRS’ overall actuarial obligation and the assets that support them with most of the remainder assigned to employers (there is also a small slice of unfunded liability that is currently unassigned). The employer’s share of the unfunded actuarial obligation is limited to service earned prior to July 1, 2014; CalSTRS cannot adjust employer contribution rates for any unfunded actuarial obligation that may develop for the new benefit structure and service accrued on or after July 1, 2014.

This means the state is mainly on the hook for an increase in the unfunded actuarial obligation that would be created if investment returns are below the 7% assumed rate of return. However, if the current crisis leads to less payroll, either through layoffs or CalSTRS member pay cuts, the employer contribution rate would need to increase as a percentage of payroll to keep employers on track to fund their portion of the unfunded liability.

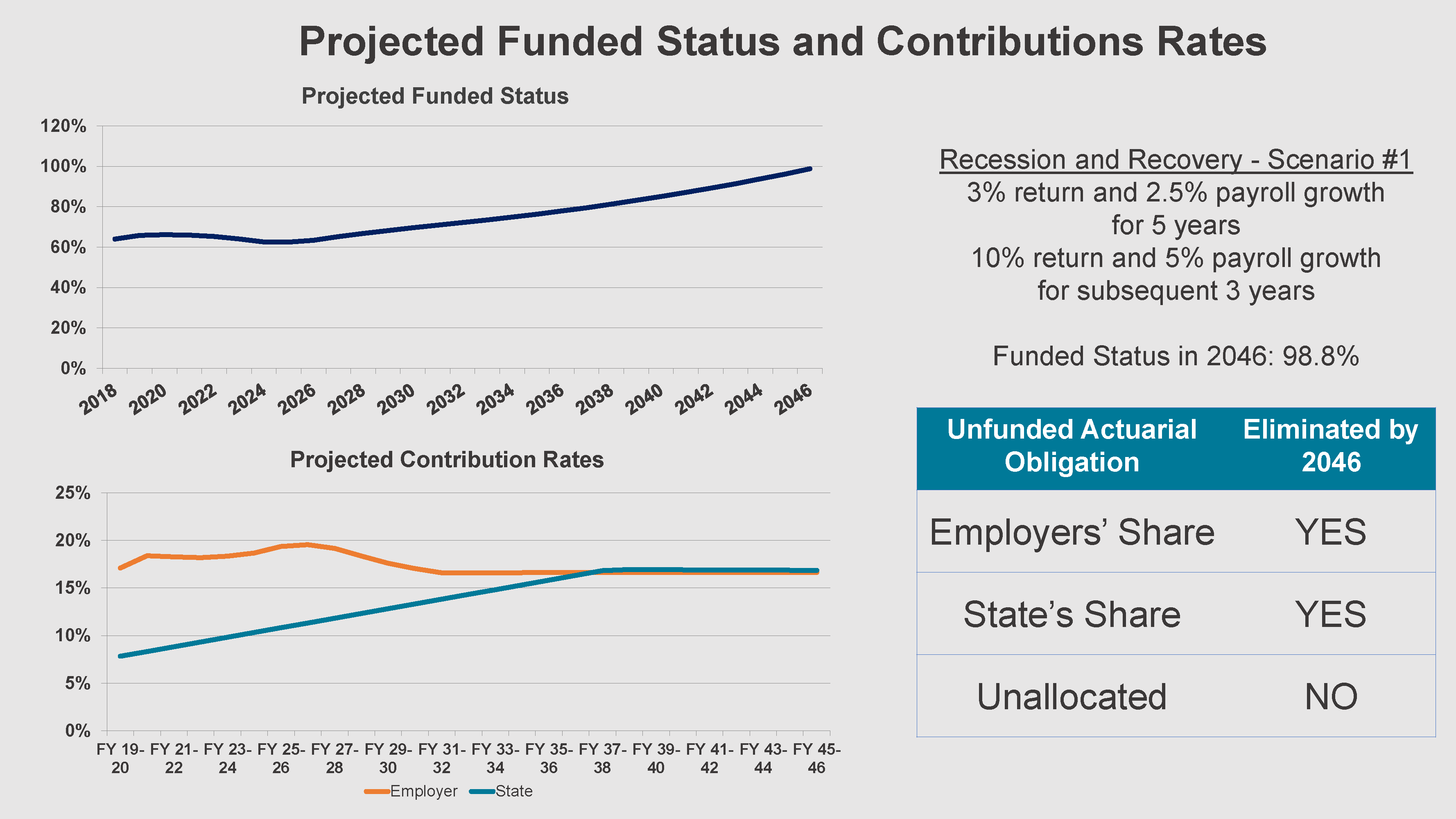

Last year, CalSTRS modelled several different recession scenarios for its Board, including a mild recession with a 3% investment return and below average payroll growth for five years, and a more severe recession scenario of 0% investment return and negative payroll growth for five years. In the milder scenario, employer contribution rates would increase for about five years, then stabilize around 17%, and the state rate would increase over a decade to about the same percentage. The unfunded liability would still be paid down by 2046.

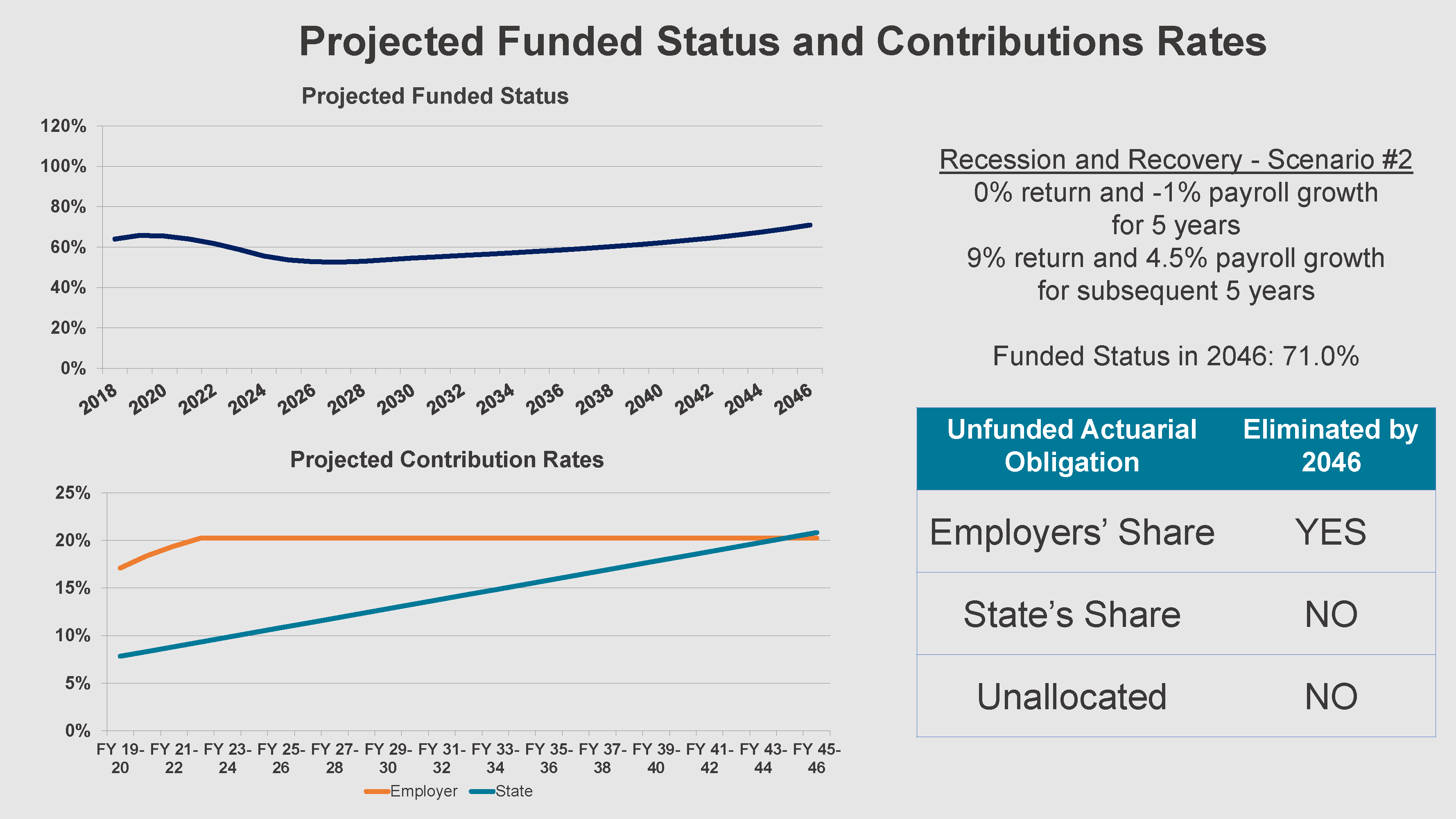

In the more severe recession scenario, the employer contribution rate would cap out at 20.25% over a three-year period and remain at that level until 2046 to fully fund the employers’ portion of the liability. The state rate would not be able to increase fast enough under current law (it can only be increased by 0.5% per year), and therefore, the state would fail to fully fund its portion of the liability. The system would be 71% funded at that point.

Finally, CalSTRS contemplates a “shock” in a single year to their investments of -7.5%, -12%, or -21%. In any of these scenarios, under current law, the system would not reach full funding by 2046.